Banking

HDFC Bank Poised for Strong Q2 Results with Double-Digit Profit Growth

HDFC Bank, the largest weighted constituent in the Nifty index following its merger with HDFC, is anticipated to announce a significant 19-25 percent increase in net profit for the June quarter. This surge in profitability is expected to be driven by a notable 20 percent-plus rise in net interest income (NII), while net interest margin (NIM) is predicted to remain relatively flat on both a sequential and year-on-year (YoY) basis.

Analysts have observed that HDFC Bank is the only bank that has consistently outpaced credit growth with its deposit growth over the past four quarters. Consequently, market watchers will be paying close attention to any commentary on the progress of the merger with HDFC. As for the quarterly results, HDFC Bank has already reported advances worth Rs 16,15,500 crore in the June quarter, reflecting a 15.8 percent increase over the same quarter last year. This translates to a modest 0.9 percent sequential growth in advances compared to the previous quarter’s Rs 16,00,600 crore. In a recent business update in early July, HDFC Bank disclosed that its deposits reached Rs 19,13,000 crore as of June 30, representing a 19.2 percent rise over June 30, 2022. Deposits also experienced a 1.6 percent increase over March 31, 2023, amounting to Rs 18,83,400 crore.

ICICI Securities predicts that HDFC Bank will achieve a 19.6 percent YoY increase in net profit, amounting to Rs 10,995 crore, compared to Rs 9,196 crore from the previous year. They anticipate that NII will climb by 24.6 percent YoY to Rs 24,266 crore, up from Rs 19,481 crore in the corresponding period. NIM is expected to settle at 4.07 percent, slightly lower than 4.10 percent in March and 4 percent in the same quarter of the previous year. Nomura India, on the other hand, forecasts a profit of Rs 11,220 crore, indicating a 22 percent increase with a 20 percent YoY rise in NII to Rs 23,390 crore. Provisions are projected to rise by 12 percent to Rs 3,580 crore, a decline from the 31.9 percent YoY growth. NIM is anticipated to stabilize at 4.1 percent.

According to HDFC Bank’s internal business classification, its domestic retail loans experienced a 20 percent YoY growth and a 4 percent QoQ growth in the June quarter. Commercial and rural banking loans saw a 29 percent YoY growth or 2 percent sequential growth, while corporate and other wholesale loans increased by 11 percent YoY but declined by 1 percent QoQ, as stated in a business update provided by HDFC Bank.

Sharekhan expects HDFC Bank to achieve a profit of Rs 11,642 crore, marking a substantial 26.6 percent YoY increase. They also project NII to rise by 19.4 percent YoY to Rs 23,263 crore, while pre-provision operating profit is anticipated to reach Rs 18,095 crore, reflecting a 17.7 percent YoY growth. As of year-to-date figures, HDFC Bank shares have risen by 1.04 percent, slightly below the 3.74 percent increase in the Nifty Bank index. The stock holds an average price target of Rs 2,105, according to Trendlyne, suggesting a potential upside of 22 percent from the current price.

Overall, HDFC Bank is poised to deliver strong Q2 results, with robust double-digit growth in profit. The bank’s focus on deposit growth, along with its strategic merger with HDFC, positions it well for continued success in the market. Investors are optimistic about HDFC Bank’s upcoming results, as analysts predict substantial growth in net profit and net interest income. The bank’s consistent deposit growth outpacing credit growth has been a key factor in driving its success. With a strong performance expected, HDFC Bank continues to be a prominent player in the banking sector.

Banking

Strategic Plan Demanded as Bank of America Seeks to Close Performance Gap with Key Rivals

Pressure is currently being faced by the executive leadership of the second-largest U.S. lending institution, as intense focus is being placed upon the need to significantly boost financial returns through strategic actions in areas such as dealmaking and wealth management. These actions are considered vital if the bank is to successfully reduce the considerable performance gap that has developed between itself and its larger industry rival. A major gathering of investors is scheduled to be convened in Boston on November 5th by the Chief Executive Officer, who has held the leadership role since 2010. During this event, a detailed strategy is expected to be formally outlined, specifying how the institution plans to achieve meaningful growth after its returns have been consistently observed to trail those of its peer group. The convening of this meeting is particularly noteworthy, as it represents the first comprehensive investor engagement of this nature to be held by the bank since 2011.

It has been suggested by informed investors that the upcoming presentation could be strategically utilized by the bank to underscore its competitive advantages in certain operational segments, particularly those pertaining to its strength in the consumer and small business lending markets. Despite these established strengths, shareholder scrutiny remains intently focused on the divisions where the bank’s performance has been found to be lacking in comparison to market leaders. Specifically, the investment banking division is widely considered to be engaging in a determined effort to close the gap in key dealmaking revenue, where it remains behind the output of major competitors. Similarly, the institution’s wealth management arm is responsible for managing fewer client assets when compared not only to the largest rival but also to a smaller, specialized competitor in that field. Consequently, the methods by which the leadership team intends to strategically close these significant market deficits in the coming years are being rigorously assessed and are expected to form a central pillar of the strategy presentation.

The institution’s performance over the last decade and a half has been subjected to pointed and highly critical analysis by prominent banking analysts. It was asserted that a “remarkable” degree of underperformance by the bank, relative to the wider industry, has been documented over the past fifteen years concerning the critical metric of loan growth. It was further observed that similar patterns of lagging performance have been noted in several other key segments, specifically including certain areas of wealth management, core investment banking activities, and credit card services. These historical deficiencies establish the challenging context against which the new growth strategy must be evaluated by the investment community. No immediate comment regarding these observations was provided by the institution.

The foundation for the current strategic focus was laid following the severe instability generated by the 2008 financial crisis, a period during which the stability of the global economic system was acutely threatened. The current leadership assumed its role shortly thereafter. Following the crisis, a challenging period was endured, during which the purchased investment bank, Merrill Lynch, which had been bought at the point of collapse, was systematically integrated into the broader structure. Crucial early actions involved the successful repayment of government bailout funds and the implementation of significant and extensive job reductions. After what was acknowledged to be a difficult initiation, a momentous organizational turnaround was successfully engineered. This reconstruction effort was consistently guided by an oft-repeated corporate mantra emphasizing “responsible growth.” The successful, multi-year rebuild that followed secured the Chief Executive a global reputation as a steady and reliable operator, leading to regular appearances on prominent international stages alongside world leaders.

Now that the financial stability of the core institution has been restored and fortified, the investment community’s attention has shifted decisively toward future profitability and the next phase of expansion. The critical question being posed by shareholders, including those represented by senior equities analysts, relates to how greater returns can be extracted from the substantial capital investments that have been made in the overall banking infrastructure over the preceding years. It is being questioned how the leadership team will translate the stability achieved through “responsible growth” into superior earnings performance that can finally meet or exceed the metrics consistently delivered by the bank’s most successful domestic rivals. The upcoming investor meeting is therefore recognized as a high-stakes event where a clear, well-defined, and implementable roadmap for achieving higher levels of sustainable profitability is urgently expected to be presented and convincingly defended. The necessity of generating high returns through the lucrative, fee-based business lines of dealmaking and asset management is considered paramount if the performance gap is to be successfully closed.

Banking

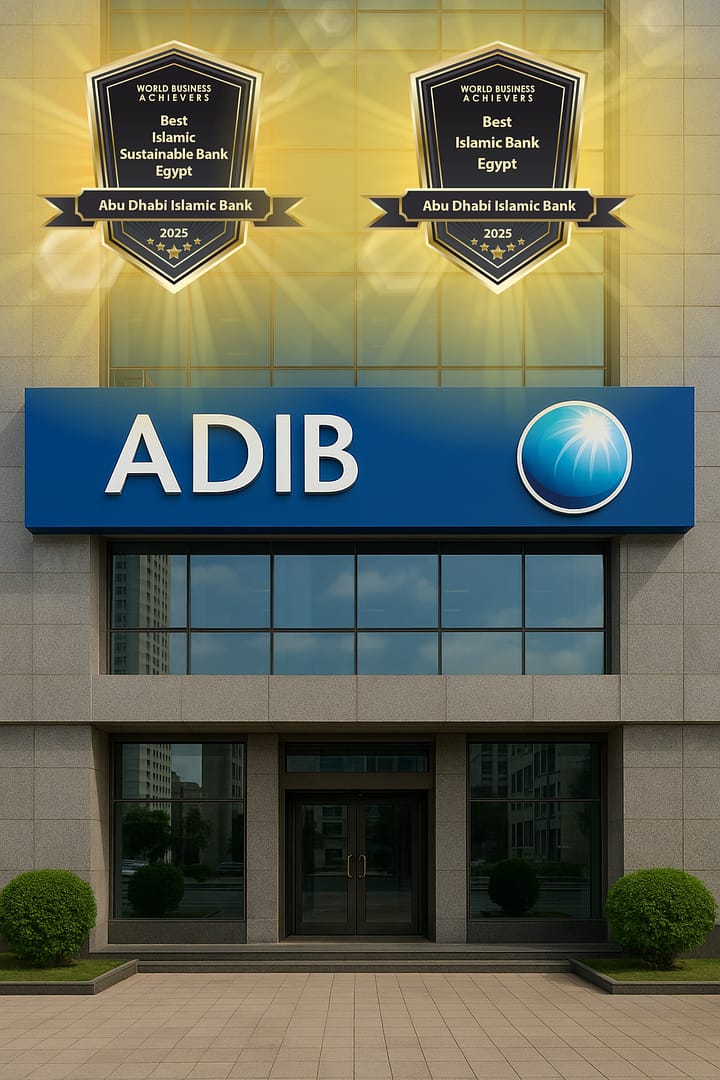

Abu Dhabi Islamic Bank – Egypt Wins Prestigious “Best Islamic Bank Egypt 2025” and “Best Islamic Sustainable Bank Egypt 2025” Awards at World Business Achievers Awards 2025

Abu Dhabi Islamic Bank – Egypt (ADIB Egypt) is proud to announce that it has been honoured with two distinguished awards at the globally recognised World Business Achievers Awards 2025: Best Islamic Bank Egypt 2025 and Best Islamic Sustainable Bank Egypt 2025. These accolades underscore the bank’s steadfast commitment to Sharia-compliant banking excellence and sustainable finance leadership in Egypt.

Key highlights of the awards:

- Best Islamic Bank Egypt 2025: This award recognises ADIB Egypt’s outstanding performance in conventional and Islamic finance across retail, corporate and investment banking, highlighting its innovative solutions, customer-centric service and market leadership.

- Best Islamic Sustainable Bank Egypt 2025: This additional honour acknowledges the bank’s pioneering role in integrating sustainability into its Islamic banking operations — including green financing, responsible investment and strong ESG (environmental, social and governance) practices.

About Abu Dhabi Islamic Bank – Egypt

Abu Dhabi Islamic Bank – Egypt (ADIB Egypt) is part of the Abu Dhabi Islamic Bank Group, one of the region’s most respected financial institutions. The bank offers a comprehensive range of Sharia-compliant products and services across retail, corporate, investment, and SME segments. With a strong focus on innovation, ethics, and social responsibility, ADIB Egypt continues to drive positive change in the Egyptian financial landscape.

About the World Business Achievers Awards

The World Business Achievers Awards celebrates excellence in global business leadership, innovation, and sustainable performance. Each year, leading organisations and executives are recognised for their contributions to shaping a more responsible and forward-thinking business world.

Banking

U.S. Banks Turn to Fed for Short-Term Funding

A recent development in the U.S. financial system has been observed, with it being reported that U.S. banks borrowed $1.5 billion from the Federal Reserve’s Standing Repo Facility (SRF) on a Monday. This particular day was noted to be the deadline for quarterly corporate tax payments and Treasury debt settlements. The borrowing, as shown by Fed data, has been seen as an indication of some tightness in the financial system in meeting its funding obligations. The SRF was established to serve as a backstop for any potential funding shortages. Launched in July 2021 in the aftermath of the COVID-19 pandemic, the Fed’s SRF provides daily overnight cash, in two separate sessions, in exchange for eligible collateral such as U.S. Treasuries.

Analysts have noted that the corporate tax payment date coincides with a large settlement of Treasury securities for recently issued debt. Data from a money market research firm, Wrightson ICAP, indicated that approximately $78 billion in payments were due to the U.S. Treasury on that Monday as well. It has been suggested that these settlements, along with the corporate tax payments, were expected to push the U.S. Treasury’s cash balance to a figure exceeding $870 billion. The borrowing from the SRF was recorded as $1.5 billion in cash during the morning session, with no further borrowings occurring in the afternoon.

This recent borrowing is not the largest that has been seen. On June 30, financial institutions had borrowed about $11.1 billion from the SRF, a transaction that was backed primarily by Treasuries as collateral. This was reported as the largest borrowing from the facility since its inception four years ago. The current utilization, however, has been described as small and in line with expectations. A U.S. rates strategist at Deutsche Bank, Steven Zeng, noted that the small utilization suggests that elevated repo levels may be providing an opportunity for some banks or dealers to make a return by sourcing funds from the Fed and then lending them out.

It was also explained that cash was tight on that day because money market funds had less excess to lend. This was attributed to the fact that they have been allocating a greater portion of their funds to T-bills. Additionally, it was noted that these funds were either losing or holding back cash for redemptions in anticipation of the corporate tax payment date.

Ahead of these significant payments, rates in the repurchase (repo) market, such as the Secured Overnight Financing Rate (SOFR), had risen above the interest rate paid on bank reserves. SOFR, which represents the cost of borrowing cash overnight with Treasuries as collateral, rose to 4.42% last Friday, a level that matched the high of 4.42% that was hit on September 5 and was the highest in two months. In contrast, the Interest on Reserve Balances (IORB) is currently at 4.40%.

The relationship between SOFR and IORB is significant. It is expected that SOFR should trade at or below IORB because banks have the option of parking their money at the Fed in a risk-free manner to earn IORB. However, when SOFR rises above IORB, it is seen as an indication of an exceptional demand for secured funding against Treasuries. This phenomenon typically occurs around the time of Treasury auction settlements. Teresa Ho, a managing director at JPMorgan, stated in a research note that while firmer SOFR levels were to be expected, the magnitude of the increase “somewhat caught us off guard.” She also noted that while the markets have largely been able to absorb the additional Treasury bill supply with ease, the reallocation of funds from the repo market to T-bills accelerated in August. This was attributed to money market funds aggressively extending their weighted average maturities, a move that was done in anticipation of potential Fed rate cuts. The current situation highlights the complex interplay between fiscal deadlines, monetary policy, and short-term funding markets.

-

Banking2 years ago

Banking2 years agoArgentina Explores Debt Management Strategies: Potential Debt Swap and IMF Discussions on the Horizon

-

Technology3 years ago

Technology3 years agoApple Introduces “Tap to Pay” Feature for iPhone, Allowing Contactless Payments

-

Banking2 years ago

Banking2 years agoHedge Funds Capitalize on U.S. Regional Banking Stocks Plunge: Insights and Implications

-

Technology2 years ago

Technology2 years agoAviation Industry Urges Swift Action Against GPS Spoofing Amid Growing Threats

-

Technology2 years ago

Technology2 years agoBitcoin Weakens as Regulatory Concerns and Market Sentiment Impact Cryptocurrency Market

-

Business2 years ago

Business2 years agoOvercoming Financial Hurdles: TotalEnergies’ Quest for Renewable Energy in Africa

-

Technology3 years ago

Technology3 years agoFTX denies talks of acquiring Robinhood

-

Forex1 year ago

Forex1 year agoNavigating Risks in Bank-Fintech Partnerships: Insights from U.S. Bank Regulator